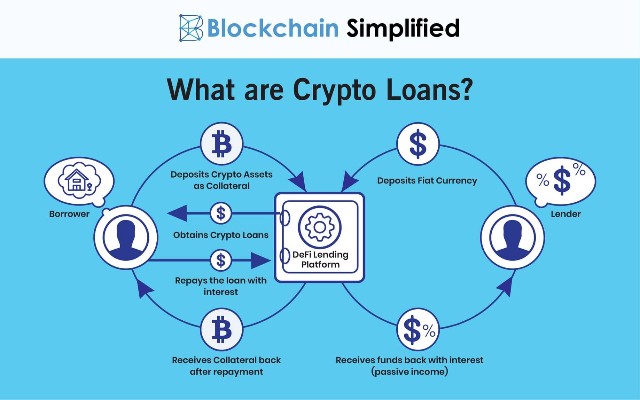

You may have heard of cryptocurrency loans before, but do you know what they are? A cryptocurrency loan is peer-to-peer lending that uses digital currencies like Bitcoin or Ethereum instead of cash.

This new form of financing has emerged in the last ten years and has quickly become one of the most popular options for people who need money today.

This blog post will cover four important steps to take if you’re considering getting a cryptocurrency loan for your business.

Important Steps to Take While Getting Cryptocurrency Loan

-

Learn how the cryptocurrency loan works

While the idea of a cryptocurrency loan may seem new, it’s very similar to traditional loans.

The main difference is that instead of using cash as collateral, you use your digital currency assets like Bitcoin or Ethereum.

Instead of paying interest on borrowed money in fiat currencies like USD and EUR, however, you pay back your borrowed currency loan process works.

-

Decide if a crypto loan is a right fit for you

Cryptocurrency loans are not appropriate for everyone. Before you decide to take out a loan, make sure that you understand how they work and whether or not they are the best option for your needs.

There are a few things to consider before taking out a cryptocurrency loan:

-Cash flow – Do you have enough cash to pay back the loan?

If your business is highly dependent on cash, it might be hard for you to meet your monthly crypto loan payments.

If this is a problem, consider sacrificing some of that money to make sure that you can cover those cryptocurrency loans.

-Liquidity – Are your digital currency assets easily converted to cash?

Cryptocurrency loans will only work if you convert the cryptocurrency into fiat money.

If that’s not possible, don’t take out a loan based on those crypto coins. You’ll need access to both traditional and peer-to-peer lending to make sure you have the best chance of getting your money back.

– Income potential – Is your business profitable?

Cryptocurrency loans are based on the value of your cryptocurrency assets.

If you’re in a flat period, then it’s unlikely that anyone will be willing to lend you money using those coins as collateral.

So it might be best to wait until things pick up again before getting a loan.

-Loan terms – How long do you need the loan for?

The amount of money that a cryptocurrency lending company will lend to you is based on your digital currency assets.

That means that if you want a longer-term, they’ll only be able to give you a smaller amount.

So make sure that you fully understand how this works before borrowing any money.

-

Find a Reputable Lender

If you decide to take out a cryptocurrency loan, the key is finding someone reliable and trustworthy.

You’ll have all sorts of options available to you online – some websites offer free loans while others charge high-interest rates or additional fees.

The best place for your business will depend on your needs; search around and find competitive lenders online.

-

Stay on Top of Your Payments

Once you’ve found a lender, it’s important to stay in touch. Make sure that you pay back the loan according to the terms and timeline that were agreed upon.

You’ll want things to go smoothly, so make sure that both parties agree about payment schedules and any other special considerations like interest rates or fees.

If you’re looking for a way to get capital quickly and with minimal hassle, then consider taking out your next loan using cryptocurrency.

The growth of this new type of financing is only going up from here, so it’s an excellent time for you to jump on the crypto-loan bandwagon!

Start by learning more about how the process works in this blog post.